Ferd’s financial results for 2023

Ferd’s value-adjusted equity totalled NOK 45.8 billion as at 31 December, up from NOK 43.0 billion as at 31 December 2022. In total, Ferd achieved a return on value-adjusted equity of 8.6 percent. After adjusting for the NOK 893 million in dividend paid to Ferd’s owners, the return in NOK terms was NOK 3.7 billion.

The return on Ferd Capital’s combined portfolio was 9.1 percent. For the privately owned investments there was a positive return of NOK 1.2 billion, representing 7.0 percent. The portfolio of listed investments had a return of NOK 0.9 billion, or 9.9 percent. Ferd’s return on its real estate portfolio was minus 1.9 percent, as a result of increase in yield for commercial real estate and somewhat higher expected future construction costs for the commercial and residential real estate projects. Ferd External Managers generated a total return of 12.4 percent (in USD terms) on its mandates. Measured in NOK, the return was 16.5 percent, primarily as a result of the weakened krone against the USD. The Norwegian krone weakened against EUR, USD and SEK during 2023 which contributed with 1.4 percent of Ferd’s overall return.

In 2023, Ferd made investments of NOK 2.4 billion and received NOK 3.0 billion from disposals and dividends. The investments in General Oceans and Forte Digital were Ferd Capital’s largest new investments during 2023. No new investments were made for the listed portfolio, but Ferd increased the investment in Mintra, among others. In total, Ferd received NOK 610 million in dividends from Ferd Capital’s investments in 2023.

As of 31 December 2023, Ferd had a net liquidity holding totalling NOK 0.5 billion. The value of Ferd’s listed investments and liquid fund investments was NOK 15.8 billion. In total, the value of Ferd’s liquidity and liquid investments was NOK 16.3 billion as at 31 December 2023, and represented 36 per cent of the value-adjusted equity. In addition, Ferd had undrawn credit facilities totalling NOK 6.0 billion.

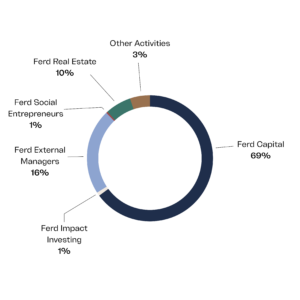

Composition of Ferd’s value-adjusted equity at 31 December 2023:

Ferd Capital

Ferd Capital is a long-term, flexible and value-adding partner for Nordic companies.

The business area has two mandates and make investments in private companies and listed companies. On 31 December 2023, Ferd Capital’s portfolio of privately owned companies consisted of Aibel, Aidian, Brav, Broodstock, Fjord Line, Fürst, General Oceans, Interwell, Mestergruppen, Mnemonic, Norkart, Servi, Simployer, and Try. The largest listed investments were Benchmark Holdings, Boozt, BHG Group, Elopak, Lerøy Seafood, Nilfisk and Trifork.

The combined return on Ferd Capital’s mandates was 9.1 percent for 2023. Aibel and Interwell were the privately owned companies that contributed the most to the increase in value, whilst Mestergruppen and Brav had a decline in value as a result of more demanding market conditions. The portfolio of listed companies had a return of 9.9 percent in 2023, mostly explained by positive return for Elopak. Elopak is Ferd’s largest listed investment and the 2023 return was 24 percent.

Ferd Capital’s portfolio had a total value of NOK 31.7 billion on 31 December 2023. The allocation between the main two mandates and other investments at 31 December 2023 was as follows:

Ferd Real Estate

Ferd Real Estate is a responsible and long-term urban developer and shall create value beyond financial returns.

The return on Ferd Real Estate’s combined portfolio was minus 1.9 percent for 2023. The main explanations for the negative return were increased yields for commercial properties as well as increased expected construction costs for projects under development. Ferd Real Estate’s biggest project, Marienlyst, had a positive value development during 2023. The project plan includes the construction of 1 200 residential units, development and restoration of The Norwegian Broadcast building of 40 000 sqm., and approx. 20 000 sqm of commercial property.

In 2023, Ferd Real Estate realised an investment in a logistics property close to the Oslo Airport. No major new investments were made during the year.

At the end of 2023, Ferd Real Estate’s portfolio had a property value of NOK 11.5 billion and an equity value of NOK 4.3 billion. As of 31 December 2023, the value was distributed between the segments as follows:

Ferd External Managers

Ferd External Managers is responsible for the group’s investments with external managers. The business area invests in funds that give Ferd an attractive international exposure.

Ferd External Managers had an aggregate return of 12.4 percent for their mandates in 2023. The portfolios are accounted for and managed in US dollars. Measured in NOK, the return was 16.5 percent, primarily as a result of the weakening of NOK against the USD in the period.

The Global Equity mandate, which is made up solely of equity funds, had a value increase of 14.1 percent measured in USD. There were large differences in return between the four investment-themes, and particularly technology-investments had a very strong year after a year with weak returns in 2022.

The Global Fund Opportunity portfolio consists of investments in hedge funds and illiquid funds. The mandate had a return of 10.3 percent measured in USD in 2023. The two multi-strategy funds, which had a very strong year in 2022, maintained good results also in 2023.

Ferd allocated NOK 500 million out of the Global Equity mandate in the first half of 2023. The market value of Ferd External Managers’ combined portfolio as at 31 December 2023 was NOK 7.5 billion.

Allocation of the Ferd External Managers portfolio between the mandates at 31 December 2023:

Ferd Impact Investing

Ferd Impact Investing invests in early-phase companies with the potential to deliver both a positive impact on the UN’s Sustainable Development Goals as well as a robust risk-adjusted return. Ferd Impact primarily invests through funds, but also makes direct investments in individual companies in partnership with others. It concentrates on the three sectors energy transition, sustainable cities and oceans.

Ferd Impact Investing has so far made 26 investments. In 2023, they have invested in four new funds as well as three new co-investments and three follow-up investments.

In the second half of 2023, Ferd Impact divested its largest investment in the company Nextwind and achieved a very good return, both financially and impact wise. This sale represented Ferd Impact’s first major realisation.

As at 31 December 2023, Ferd Impact Investing had invested NOK 569 million in current investments and committed a further NOK 342 million. The fair value of Ferd Impact’s portfolio was NOK 615 million.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs that deliver social and financial results and has a goal to improve their chances of success through a combination of capital, expertise and networking. FSE also collaborates with the public sector to contribute to new tools and improved frameworks for social entrepreneurs.

At the end of 2023, there were 11 companies and three fund investments in FSE’s portfolio. The most important event during the year, was the merger between Auticon and Unicus. FSE has had investments in both companies over a longer period. The merger created the world’s biggest company where the majority of employees has some form of autism. FSE has also invested in two new companies and one fund during 2023.

In 2022, FSE also launched its “Oslo initiative”. In the Oslo initiative, they bring together businesses and foundations for a joint effort for the more socially vulnerable areas in Oslo. Together we would like to contribute to more young people from these areas participating in activities, completes high school education, and gets as lasting relationship to working life. As of today, the Oslo initiative has supported 15 foundations with this purpose.

Other Activities

Other activities mainly consist of bank deposits, money market funds, and investments in prior mandates under liquidation.